By Pitipong Santadram, Payroll Manager

Due to the economic impact of the COVID-19 epidemic in Thailand and to alleviate the burden to employers and provide more liquidity as well as reduce the burden to employees and citizens in general who are suffering from the cost of living crisis, the cabinet has agreed to reduce Social Security contributions under Sections 33 and 39 for three months, effective from October to December 2022.

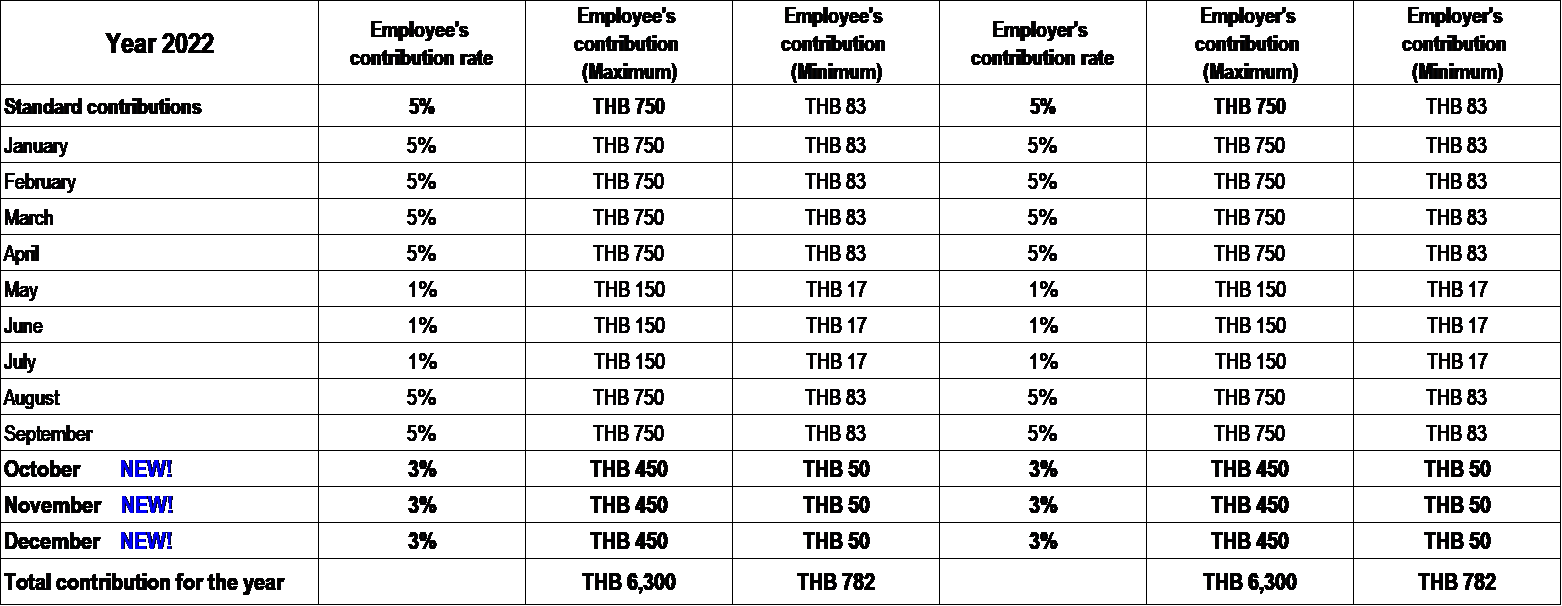

Following these reductions, employee and employer’s contributions to Social Security have been adjusted to 3% of salary, with a maximum contribution of THB 450 per month / a minimum contribution of THB 50 per month, for October, November, and December 2022.

Remarks: If the social security contribution rate is as follows until the end of the year 2022, employees will be eligible for a social security deduction for tax calculation, of up to 6,300 baht.

In addition, the government continues to provide assistance in keeping with the living conditions and the cost of living situation by reducing the contribution to Social Security under section 39 to 240 baht per month.

Should you have any queries about this article or wish to know more about the RSM Payroll Bangkok services, please do not hesitate to contact Khun Pitipong Santadram on email askus@ rsmthailand.com

*Source of information: on the website, www.sso.go.th